Overview

Overview

DFCC Bank offers a comprehensive range of Treasury products and services delivered by experienced and competent dealers who understand your needs. We understand that in volatile market conditions, every second counts and our dealers go that extra mile to deliver a fast and efficient service. We offer competitive interest rates and exchange rates, when compared to other market participants, enabling you to fulfill your investment and foreign exchange needs with the least amount of documentation and flexible processes, ensuring that you receive a superior experience.

Investment Products

Investment Products

- Treasury Bills

Treasury Bills are a short term investment issued through primary auctions conducted by the Central Bank of Sri Lanka (CBSL) on behalf of the Government of Sri Lanka. They are considered secure investments as the local investor assumes zero default risk. CBSL currently issues T-bills with original maturities of 91, 182 and 364 days.

Applicable rates (Valid from 14 March 2024 to 20 th March 2024)

- 03 Months – 10%

- 06 Months – 10%

- 01 Year – 10%

- Treasury Bonds

Treasury Bonds are issued by the Central Bank of Sri Lanka on behalf of the Government through primary auctions. These Bonds are considered to be medium and long term instruments with zero default risk for local investors, with the maturity period ranging from 2 years to 30 years. These Bonds carry a semi-annual coupon and are auctioned regularly by the Central Bank on behalf of the Government.

- Investments can be done for 1-5 year Bonds

- Please call us for attractive rates. 0762637487 / 0762621301

- Repo and Reverse Repo on Government Security

A Repurchase Agreement (REPO) is an agreement between the Bank and the client where the Bank borrows funds against collateral of Treasury Bills or Bonds from a client for a specified period of time and a mutually agreed rate of interest. Repo investments are money market instruments which provide flexibility in terms of the tenor ranging from overnight to one year. Hence this sort of instrument is widely used by customers to make investments assuming sovereign risk.Check Current Repo Rates

“Short-term investment opportunity backed by Government securities as collateralsâ€

Applicable rates (Valid from 14 March 2024 to 20th March 2024) – Pls include the publish rates.

A Reverse Repurchase Agreement (REVERSE REPO) is an agreement between the Bank and the client, where the Bank lends to the client against the client’s Treasury Bills or Bonds for a specified period of time and a mutually agreed rate of interest. This is the opposite of Repo investments. It provides the customer with the ability to borrow short term funds, against the Government securities they have already invested in, generally with a yield advantage in comparison to traditional overdraft facilities etc.

“Short-term borrowing opportunity for existing Government security holders at attractive ratesâ€

Please call us for attractive rates. 0762637487 / 0762621301

- Repo’s backed by Corporate Debt Instruments

This is similar to a Repo on Government Security. However, instead of getting sovereign instruments as collateral, the customer assumes the default risk of DFCC Bank. Corporate Debt backed REPO generally provides customers with a yield advantage compared to traditional FD or Government security backed REPO.

- Sri Lanka Development Bonds (SLDB)

Sri Lanka Development Bonds (SLDB) are USD denominated instruments issued by the Government of Sri Lanka, where interest is paid semi-annually (either on a variable rate based on a 6 month LIBOR rate plus a fixed margin or a fixed rate). Eligible investors include foreign citizens and entities, non-resident Sri Lankans, Sri Lankan dual citizens, holders of personal foreign currency accounts and business foreign currency accounts, Licensed Specialised Banks and Licensed Finance Companies who have been permitted to accept deposits in foreign currency, Authorised Dealers in foreign exchange, Primary Dealers in Government securities and other specified companies by the Central Bank of Sri Lanka from time to time. The minimum investment amount is USD 10,000/- and the investor assumes the credit risk of Government (i.e Sovereign Risk). The yield of this instrument will vary based on the rate at which the customer wishes to bid at the auction.

- Dual Currency Deposit (DCD)

DCD offered by the DFCC Bank is a tailor-made structured yield enhancement product, linked to foreign exchange markets. It provides customers who have exposure in two or more foreign currencies to maximise returns on investments enabling them to create a foreign exchange investment strategy to match his/her personal preferences.

Example: Client invests GBP 250,000 in Dual Currency Deposit for a tenor of 1 month specifying the FX conversion rate / Strike Rate at 1.5650 with GBP 0.0100 spread from the current market rate (Base rate/Spot Rate) of GBP/USD 1.5550.The resulting interest rate will be 8.00% p.a.

- Scenario 1:

The market exchange rate on the FX fixing date is GBP/USD 1.5375.Client will receive both Principal and the Interest in GBP.- Principal          GBP 250,000

- Interest            GBP 1,643.84

(250,000*8%/365*30) - Repayment     GBP 251,643.84

- Scenario 2:

The market exchange rate on the FX fixing date is GBP/USD 1.5725. Client will receive both Principal and the Interest converted to USD.- Principal          GBP 250,000

- Interest            GBP 1,643.84

(250,000*8%/365*30) - GBP 251,643.84*1.5650

- Repayment     USD 393,822.61

Nonetheless, if the strike price is hit and the customer gets interest and capital in the 2nd currency, any immediate conversion back to the 1st currency could result in a loss of capital. Therefore this product is meant for customers who fully understand the risk and / or is indifferent to what currency the gains return in.

FX Products

FX Products

- Foreign Exchange Transactions

DFCC treasury facilitates foreign exchange requirements of customers by offering competitive market rates to meet their needs.

- Forward Foreign Exchange Agreement

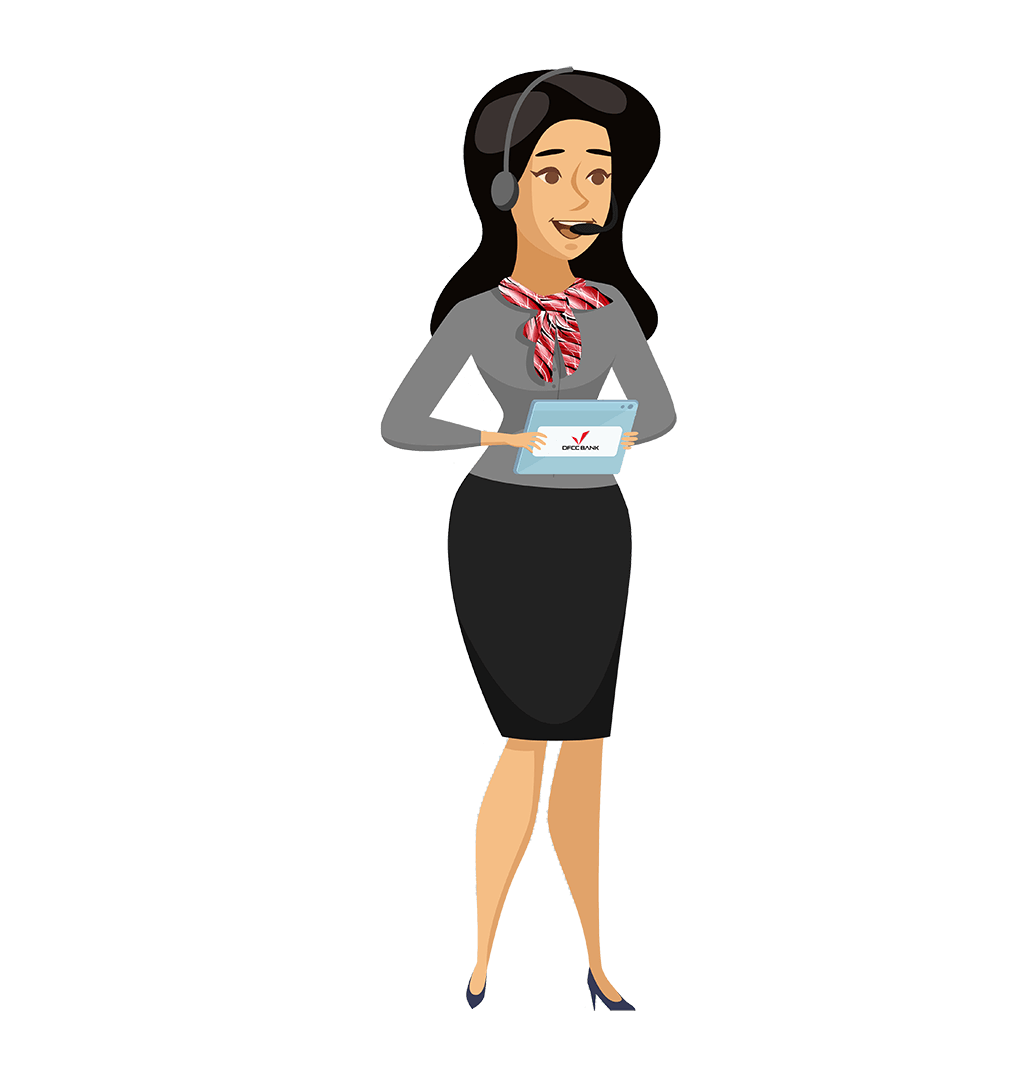

A Foreign Exchange Forward Contract is a binding obligation between the Bank and the customer to buy or sell a specific amount of foreign currency,in order to hedge an underlying foreign exchange exposure,at a predetermined exchange rate on an agreed future date.

The following depicts an example of the potential opportunity loss or gain that can occur when an importer or exporter books a forward contract. It depicts the two scenarios when the market spot rate is above or below the fixed forward rate at the time of maturity of a forward. Furthermore, the example assumes a forward rate of 183.00 for 5 months was agreed on the 1st of January for a contract value of USD 100,000/-.

- Foreign Exchange Options Contracts

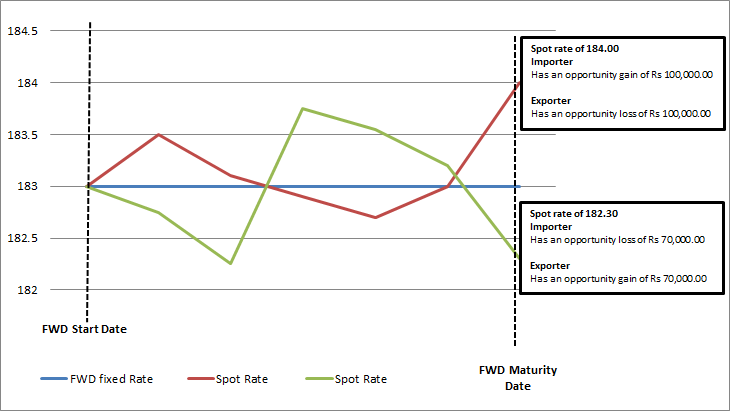

An option is an agreement that gives the buyer, who pays a fee (premium), the right but not the obligation to buy or sell a specified amount of an underlying asset at an agreed upon price (strike or exercise price) on the expiration of the contract (expiry date). A call option is a right to buy the underlying asset and a put option is a right to sell the underlying asset.

The following depicts an example of when an importer or exporter books a foreign exchange option contract. The example below depicts the two scenarios when the “market rate†is above or below the “Strike Price†at the time of “Fixingâ€. The example assumes the customer agreed a “Strike Price†of 183.40 for 5 months on the 1st of January for a contract value of USD 100,000/- when the market spot was 183.00 by paying a premium of USD 500/-.

Required documents

Required documents

Already a DFCC client ?

- CDS account opening format – For Any product

- MRA Format For Repo/Reverse repo transactions

- BR Format Only applicable for Corporate Clients

New Client to DFCC ? Click Here

-

Please call us to support the onboarding process

- O76 263 7487

- 076 262 1301

Contacts

Contacts

Treasury and Resource Mobilisation Department

DFCC Bank PLC

No 73/5, Galle Road

Colombo – 03

Sri Lanka.

Treasury Front Office

| Name | Designation | Contact Number |

|---|---|---|

| Gayan Kaushalya | Assistant Vice President / Chief Dealer | 0112442780 |

| Kasun Pathirage | Assistant Vice President | 0112442781 |

| Nilushika Gamage | Assistant Vice President | 0112442782 |

| Manoj Salgado | Senior Foreign Exchange & Money Market Manager  / Senior Dealer | 0112442777 |

| Nipuna Rathnayake | Assistant Treasury Sales Manager/ Assistant Dealer | 0112442771 |

| Ryan Jansan | Assistant Treasury Sales Manager/ Assistant Dealer | 0112442778 |

| Samudra Chandrasekara | Assistant Dealer | 0112442773 |

| Charith Jayasundara | Executive | 0112442783 |

| Gayathri Samarasinghe | Junior Executive | 0112442331 |

Warning: Undefined variable $curr_category in /var/www/html/dfcc.lk/wp-content/themes/dfccbank/template-parts/post/inquire-form.php on line 57

Warning: Trying to access array offset on value of type null in /var/www/html/dfcc.lk/wp-content/themes/dfccbank/template-parts/post/inquire-form.php on line 103

Warning: Trying to access array offset on value of type null in /var/www/html/dfcc.lk/wp-content/themes/dfccbank/template-parts/post/inquire-form.php on line 104

Warning: Trying to access array offset on value of type null in /var/www/html/dfcc.lk/wp-content/themes/dfccbank/template-parts/post/inquire-form.php on line 104

Warning: Trying to access array offset on value of type null in /var/www/html/dfcc.lk/wp-content/themes/dfccbank/template-parts/post/inquire-form.php on line 108